Free Options Trading Course

Lesson Seven

Advanced Options Trading Strategies

The seventh lesson in our free options trading course covers advanced options trading strategies which includes long straddle, short straddle, long strangle, short strangle, iron condors, butterflies, and synthetic positions.

Long Straddle and Short Straddle

Long straddle and short straddle are both advanced options trading strategies that allow traders to profit from volatility in the underlying asset.

A long straddle involves buying both a call option and a put option on the same underlying asset with the same strike price and expiration date. This strategy is used when a trader expects a significant price movement in either direction. If the price moves up, the call option will generate profit, and if the price moves down, the put option will generate profit. The potential for profit is unlimited, and the potential for a loss is limited to the premiums paid for the options.

The example in the image above illustrates how an options trader can buy both a call option with a strike price of $92 and a put option with a strike price of $92 simultaneously resulting in a long position in both the call and the put, which is one of the advanced options strategies covered in this lesson. This options strategy is called Long Straddle. The options trader’s maximum profit is unlimited since a stock could hypothetically go up indefinitely, and the maximum loss is limited to the premium paid for the straddle. The image below illustrates the potential profit and loss.

One of the advanced options trading strategies is straddles. The above diagram illustrates the profit and loss potential for a Long Straddle which is long the $92 call and long the $92 put. The cost of the straddle in this case is:

$7.00 x 100 = $700

The maximum loss is equal to the cost of the straddle which is $700. The maximum loss lies at the strike price, which is $92 at which point the call option, and the put option are worthless at expiration. Profit is achieved if the stock moves by more than the total premium paid in either direction as seen in the illustration above. The maximum profit is hypothetically unlimited since stocks can go up indefinitely, but realistically it is capped at $8500 if the stock goes down to zero, and whatever the true ceiling price is for stock to go up to by expiation less the strike price and cost of the options.

A short straddle involves selling both a call option and a put option on the same underlying asset with the same strike price and expiration date. This strategy is used when a trader expects the underlying asset’s price to remain relatively stable. In this strategy, the trader collects the premiums from both the call and put options. If the price remains stable, the trader keeps the premiums as profit. However, if the price moves significantly in either direction, the trader can face unlimited losses.

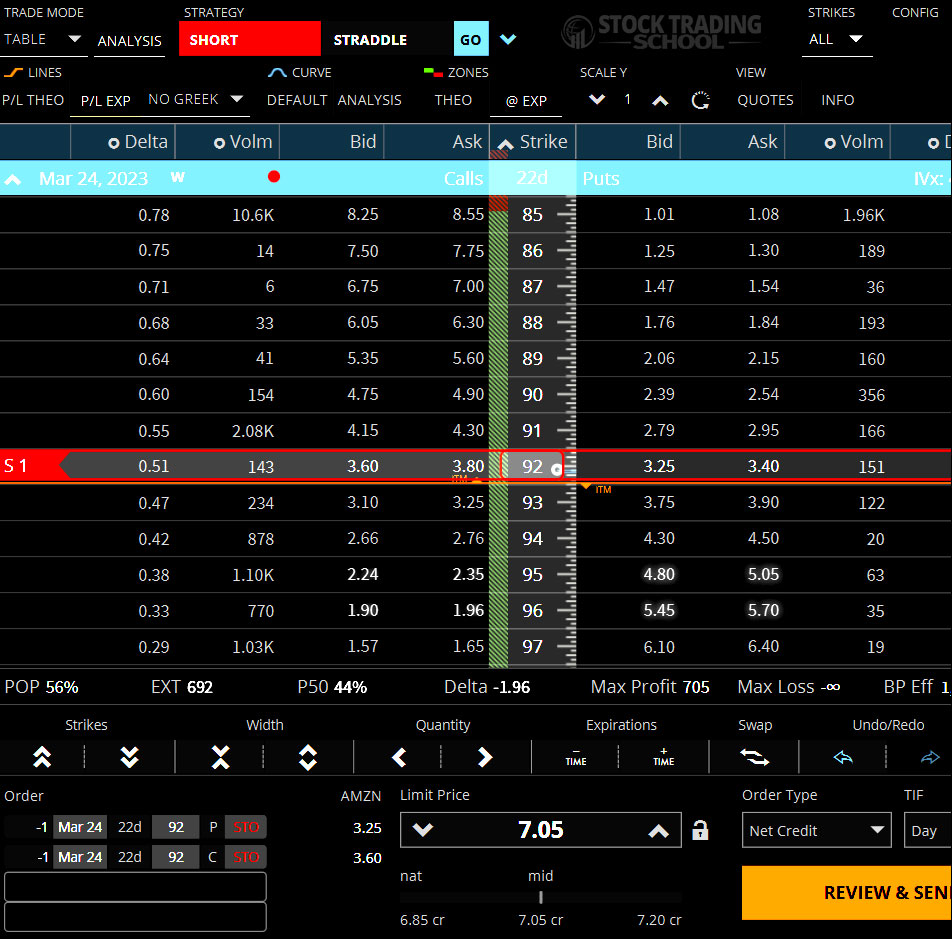

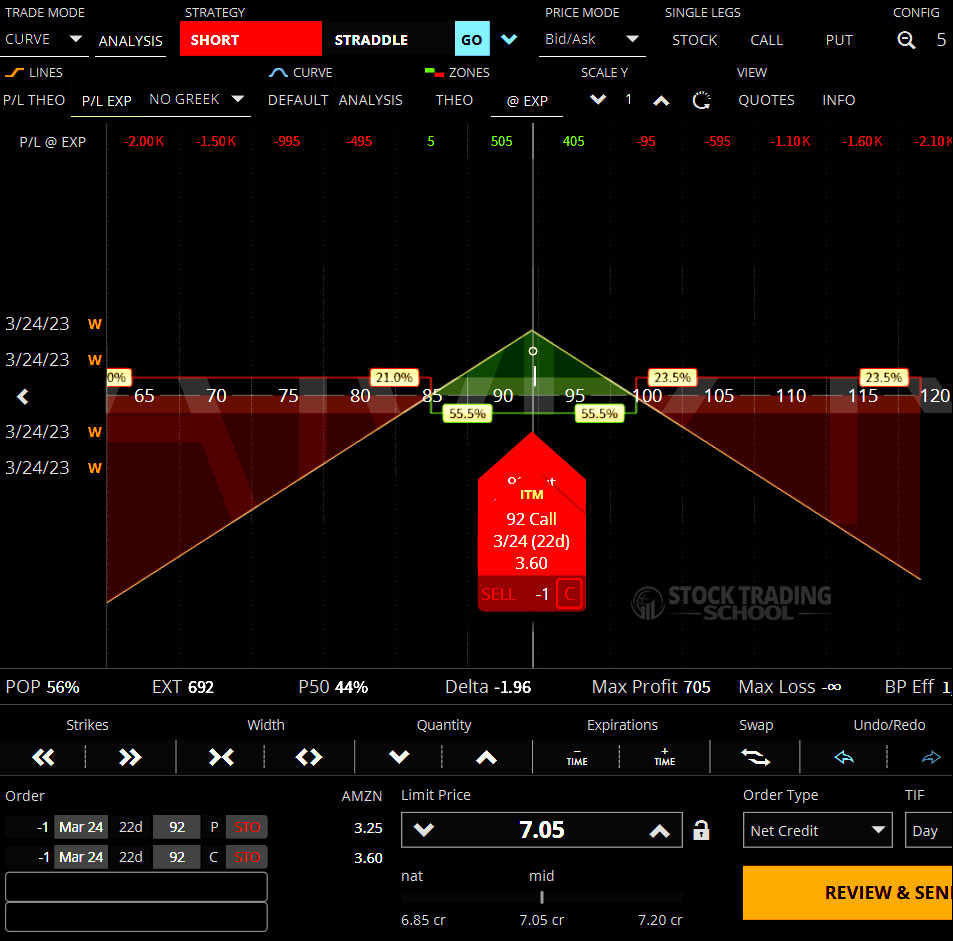

The example in the image above illustrates how an options trader can sell both a call option with a strike price of $92 and a put option with a strike price of $92 simultaneously resulting in a short position in both the call and the put, which is one of the advanced options strategies covered in this lesson. This options strategy is called Short Straddle. The options trader’s maximum loss is unlimited since a stock could hypothetically go up indefinitely, and the maximum profit is limited to the premium received (credit) for the straddle. The image below illustrates the potential profit and loss.

One of the advanced options trading strategies is straddles. The above diagram illustrates the profit and loss potential for a Short Straddle which is short the $92 call and short the $92 put. The credit received for the straddle in this case is:

$7.05 x 100 = $705

The maximum profit is equal to credit received for the straddle which is $705. The maximum profit lies at the strike price, which is $92 at which point the call option, and the put option are worthless at expiration. Profit is achieved if the stock does not move by more than the total premium received ($7.05) in either direction as seen in the illustration above.

The maximum loss is hypothetically unlimited since stocks can go up indefinitely, but realistically it is capped at $8500 if the stock goes down to zero, and whatever the true ceiling price is for stock to go up to by expiation less the strike price and the credit received for selling the straddle.

Both long straddle and short straddle strategies are advanced options trading strategies that require careful consideration and risk management. These strategies can offer high-profit potential, but they also come with a higher level of risk, especially the short straddle strategy.

Therefore, options traders should thoroughly understand the stock, the market conditions, and the potential risks involved before implementing these advanced options trading strategies. It is extremely important to have a solid understanding of advanced options trading strategies and to have a risk management plan in place to manage open options positions and mitigate potential losses.

Long Strangles and Short Strangles

Long and short strangles are advanced options trading strategies used to potentially profit from significant price movements in the stock or ETF. A long strangle involves buying both a call option and a put option on the same underlying asset, with the same expiration date but at different strike prices. The goal is to profit from a significant price movement in either direction. The profit potential is theoretically unlimited on the upside, and limited on the downside, but the risk is limited to the initial cost of purchasing the options. This strategy is used when there is a high probability of a significant price movement, but the direction is uncertain.

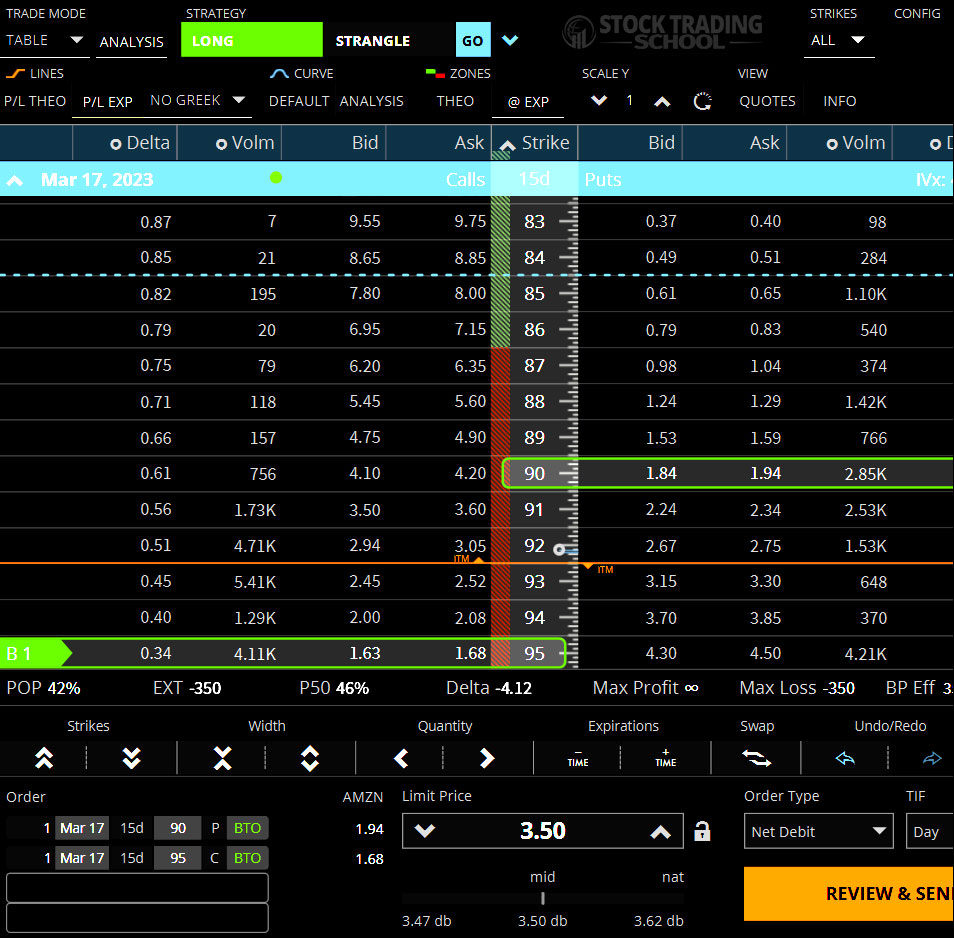

The example in the image above illustrates how an options trader can buy both a call option with a strike price of $95 and a put option with a strike price of $90 simultaneously resulting in a long position in both the call and the put, which is one of the advanced options strategies covered in this lesson. This options strategy is called Long Strangle. The options trader’s maximum profit is unlimited since a stock could hypothetically go up indefinitely, and the maximum loss is limited to the premium paid for the straddle. The image below illustrates the potential profit and loss.

One of the advanced options trading strategies is strangles. The above diagram illustrates the profit and loss potential for a Long Strangle which is long the $95 call and long the $90 put. The cost of the straddle in this case is:

$3.50 x 100 = $350

The maximum loss is equal to the cost of the straddle which is $350. The maximum loss lies at between the strike prices of the options, which is $90 to $95, at which point the call option, and the put option are worthless at expiration. Profit is achieved if the stock moves up above $95, or below $90 by more than the total premium paid in either direction as seen in the illustration above.

The maximum profit is hypothetically unlimited since stocks can go up indefinitely, but realistically it is capped at $8650 if the stock goes down to zero, and whatever the true ceiling price is for stock to go up to by expiation less the strike price and cost of the options.

A short strangle involves selling both a call option and a put option on the same underlying asset, with the same expiration date but at different strike prices. The goal is to profit from a lack of significant price movement. The profit potential is limited to the premiums received from selling the options, but the risk is theoretically unlimited on both the upside and downside. This strategy is used when there is a low probability of a significant price movement.

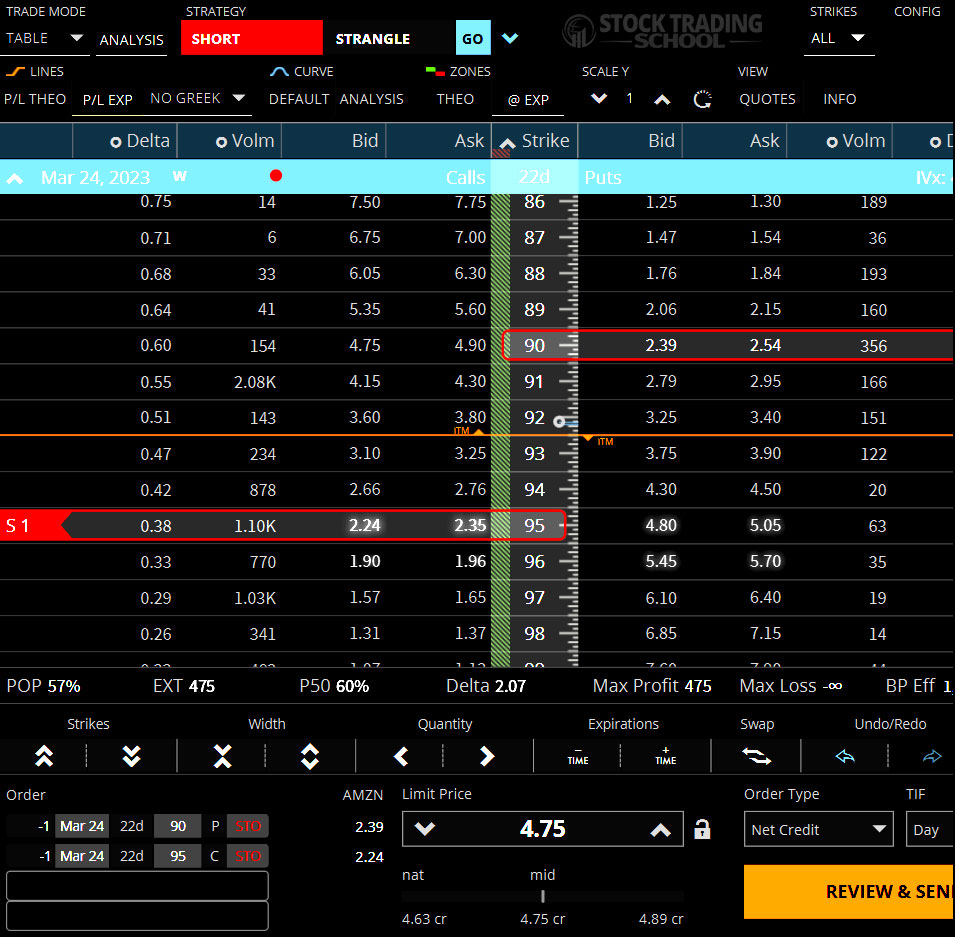

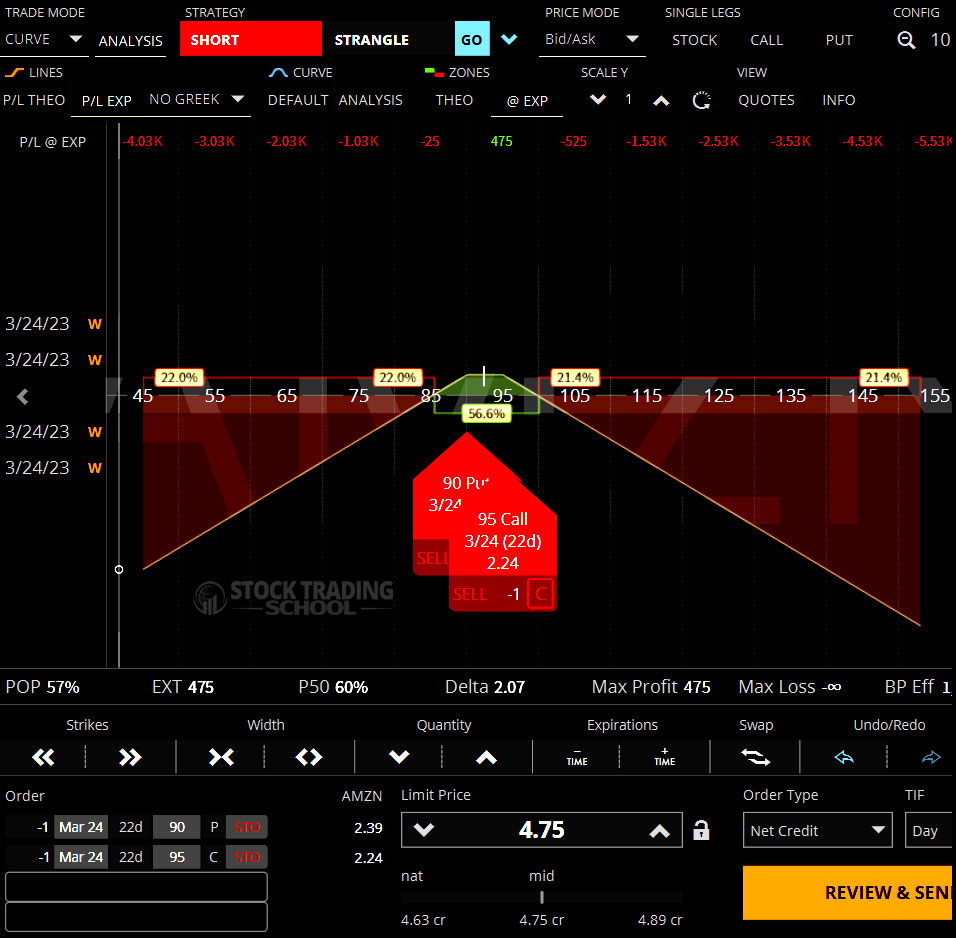

The example in the image above illustrates how an options trader can sell both a call option with a strike price of $95 and a put option with a strike price of $90 simultaneously resulting in a short position in both the call and the put, which is one of the advanced options strategies covered in this lesson. This options strategy is called Short Strangle. The options trader’s maximum loss is unlimited since a stock could hypothetically go up indefinitely, and the maximum profit is limited to the premium received (credit) for the strangle. The image below illustrates the potential profit and loss.

One of the advanced options trading strategies is strangles. The above diagram illustrates the profit and loss potential for a Short Strangle which is short the $95 call and short the $90 put. The credit received for the straddle in this case is:

$4.75 x 100 = $475

The maximum profit is equal to credit received for the straddle which is $475. The maximum profit lies at between the strike prices of $90 and $95, at which point the call option, and the put option are worthless at expiration. Profit is achieved if the stock does not move by more than the total premium received ($4.75) in either direction as seen in the illustration above.

The maximum loss is hypothetically unlimited since stocks can go up indefinitely, but realistically it is capped at $8525 if the stock goes down to zero, and whatever the true ceiling price is for stock to go up to by expiation less the strike price and the credit received for selling the strangle.

Both long and short strangles are considered advanced options trading strategies because they involve buying or selling multiple options with different strike prices and expiration dates, which can increase the complexity and risk of the trade. Options traders should carefully consider their risk management plan before implementing these advanced options trading strategies.

Butterfly Spreads

One of the advanced options trading strategies is the butterfly spread which is used by options traders who expect a moderate move in the underlying stock price while minimizing risk. It is constructed by simultaneously purchasing and selling options contracts with the same expiration date but different strike prices, creating a position with a limited risk and limited reward.

To create a butterfly spread, the options trader would typically buy one option with a lower strike price, sell two options with a higher strike price, and then buy another option with an even higher strike price. The two sold options form the “wings” of the butterfly, while the two purchased options form the “body” of the butterfly.

The maximum profit for a butterfly spread is achieved when the underlying asset’s price is at the middle strike price at expiration as seen in the illustration above. The maximum loss is the cost of the options contracts purchased, which in this case is $21. This options trading strategy is generally used when the trader has a neutral outlook on the underlying asset’s price.

Butterfly spreads can be constructed using either call options or put options. A call butterfly spread is constructed by buying one call option at a lower strike price, selling two call options at a higher strike price, and buying one call option at an even higher strike price. A put butterfly spread is constructed in a similar manner, but using put options instead of call options.

The key to successfully using a butterfly spread as a part of your advanced options trading strategies is to select the appropriate strike prices for the options contracts. This requires a careful analysis of the stock’s price movements, volatility, and other factors that can affect the price of the options. Please remember that this options trading strategy requires a high level of skill and experience to execute effectively, since it will most likely need to be closed prior to expiration to avoid exercise and assignment risks.

The butterfly spread is one of the featured advanced options trading strategies in this lesson. It is used by experienced options traders who are looking to profit from a moderate move in the stock price while minimizing risk. It is constructed by purchasing and selling options contracts with the same expiration date but different strike prices, creating a position with a limited risk and limited reward. It is important to carefully analyze the stock’s price movements, volatility, and other factors to select the appropriate strike prices for the options contracts.

Iron Condor

Iron condor is an advanced options trading strategy used by experienced traders. This strategy is a combination of a bull put spread and a bear call spread. It is a non-directional strategy, meaning that it can be used in a market that is expected to stay stable, with no significant price changes.

The iron condor strategy involves selling a put option with a strike price below the current stock price and buying a put option with an even lower strike price to limit potential losses. At the same time, it also involves selling a call option with a strike price above the current stock price and buying a call option with an even higher strike price to limit potential losses.

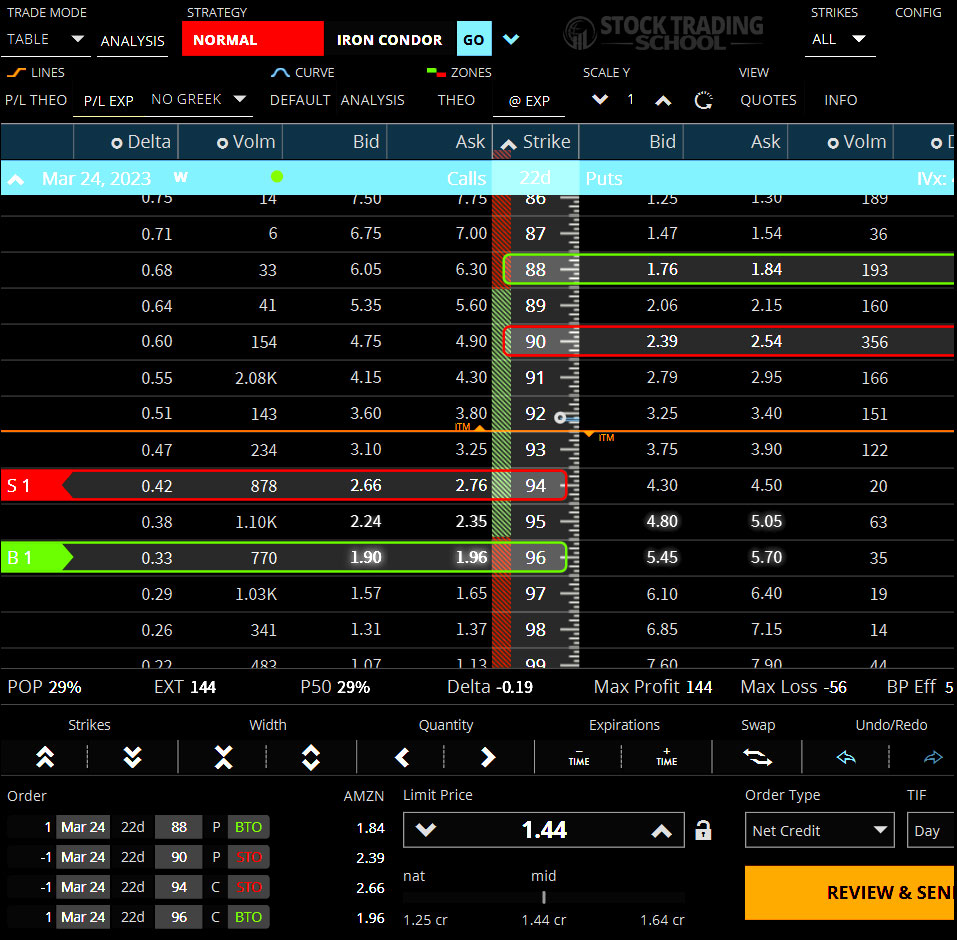

As one of the advanced options trading strategies discussed in this lesson, the above example shows a normal Iron Condor for Amazon stock that is established by selling the $90 put and buying the $88 put and at the same time selling the $94 call and buying the $96 call. The options trader in this case will receive $1.44 X 100 = $144 credit.

The goal of this strategy is to earn a profit from the premiums collected while limiting potential losses. The maximum profit that can be earned with this strategy is the credit collected which is $144.

Iron Condor is one of the most popular advanced options trading strategies. The above diagram illustrates the profit and loss potential for a Iron Condor which is short the $90 put, long the $88 put, short the $94 call, and long the $96 call. The credit received for the Iron Condor is $1.44 x 100 = $144. The maximum profit is equal to credit received for the Iron Condor which is $144 and is realized if the stock closes between the two short options strike prices which is between $90 to $94.

The maximum loss occurs if the stock trades above the long call strike price ($96) or below the long put strike price ($88). The maximum loss is equal to the difference (distance) between the strike prices that expire in the money less the credit received. If stock closes above $96, then ($96 – $94) X 100 – $144 = $56. If the stock closes below $88, then ($90 – $88) X 100 – $144 = $56.

It is important to mention that as time goes by and stock prices move up or down, an integral part of advanced options trading strategies is how they are managed which includes adjustment trades where one leg of the trade may be rolled to another strike price or expiration date. These strategies are very advanced in nature and are beyond the scope of this introductory course. If you are interested in learning more about trading strategies for stocks and options feel free to subscribe to our newsletter to receive notifications and updates.

As mentioned earlier, Iron Condor is one of the most popular advanced options trading strategies when an options trader expects slight movement up or down in stock prices. On the other hand, a reverse Iron Condor is one of the popular advanced options trading strategies for options trader who think there can be a moderate movement in stock prices up or down.

The above example shows a reversed Iron Condor for Amazon stock that is established by buying the $90 put and selling the $88 put and at the same time buying the $94 call and selling the $96 call. The options trader in this case is expecting Amazon stock price to move either above $96 or below $88 in the next 22 days. The options trader is willing to pay $1.44 X 100 = $144 premium for this trade.

Reversed Iron Condor is one of the popular advanced options trading strategies for speculation on a moderate or even significant move in stock prices. The above diagram illustrates the profit and loss potential for a reversed Iron Condor which is long the $90 put, short the $88 put, long the $94 call, and short the $96 call. The premium paid for the reversed Iron Condor is $1.44 x 100 = $144. The maximum loss is equal to premium paid for the reversed Iron Condor which is $144 and is realized if the stock closes between the two short options strike prices which is between $90 to $94.

The maximum profit occurs if the stock trades above the long call strike price ($96) or below the long put strike price ($88). The maximum profit is equal to the difference (distance) between the strike prices that expire in the money less the premium paid. If stock closes above $96, then ($96 – $94) X 100 – $144 = $56. If the stock closes below $88, then ($90 – $88) X 100 – $144 = $56.

Iron condor and reversed Iron Condor are advanced options trading strategies that involves either buying or selling two vertical spreads simultaneously. The normal Iron Condor is a non-directional strategy used in stable markets to earn a profit from premiums collected while limiting potential losses while the reversed Iron Condor is used by options traders who are expecting moderate or significant (depending on the strike prices selected) move up or down in stock prices. Risk management for options trading is critical when using this strategy to minimize risks and maximize profits.

Synthetic Positions

The creation of synthetic positions is an advanced options trading strategy that allows traders to replicate the performance of a long or short stock position using a combination of call and put options. By buying a call option and selling a put option with the same strike price and expiration, traders can create a synthetic long stock position that profits from an increase in the underlying stock price. On the other hand, buying a put option and selling a call option with the same strike price and expiration creates a synthetic short stock position that profits from a decrease in the underlying stock price.

The advantage of synthetic positions is that they can be created with lower capital requirements than a direct stock purchase or short sale (due to lower initial margin requirements for naked calls or puts). In addition, they may offer flexibility in managing risk, as traders can adjust their positions by adding or subtracting options as needed.

As always, it is extremely important to understand the risks associated with synthetic positions, as they involve trading multiple options contracts, each with their own risks and complexities. Investors need be well funded and have a thorough understanding of advanced options trading strategies and market conditions to execute synthetic positions effectively.

Advanced options trading strategies provide traders with powerful tools to manage risk and generate profits. However, it is important to remember that with increased potential for profit comes increased potential for loss. It is essential to fully understand the risks involved and to have a solid understanding of the strategy being employed.

As with any type of trading, proper risk management is crucial when using advanced options trading strategies. It’s important to have a plan in place for both profit and loss scenarios, as well as to monitor positions closely.

Despite the potential risks, advanced options trading strategies can be a valuable addition to any trader’s toolkit. By using the right strategy at the right time and with the proper risk management, options traders can achieve their financial goals and increase their chances of success in the markets.

Students are encouraged to continue learning and expanding their knowledge of advanced options trading strategies. it is important to approach these strategies with caution and to always prioritize risk management above all else. Remember, the goal is to generate profits, but not at the cost of losing everything. So, always trade responsibly and seek professional advice if needed.

Get FREE Early Access to

Exclusive Trading Content!

Find the Next BIG Investment Opportunity Before Everyone Else

This concludes the Advanced Options Trading Strategies lesson. Please use the menu below to navigate to the lesson of your choice.