Free Options Trading Course

Lesson Six

Intermediate Options Trading Strategies

The sixth lesson in our free options trading course covers intermediate options trading strategies which includes vertical spreads, bull call spread, bear call spread, bull put spread, bear put spread, debit spreads and credit spreads, horizontal spreads (calendar spreads), and diagonal spreads.

How to Use Vertical Spreads in Options Trading?

Vertical spreads are one of the most popular options trading strategies used by options traders to potentially reduce risk and maximize profit potential. A vertical spread is a type of options spread where a trader buys and sells two options of the same expiration date and the same stock, but with different strike prices. There are two types of vertical spreads: bull spreads and bear spreads.

Bull spreads are used when a trader expects the price of the underlying asset to rise. In a bull call spread, the trader buys a call option with a lower strike price and sells a call option with a higher strike price. The trader’s profit potential is limited to the difference between the two strike prices, minus the cost of the options.

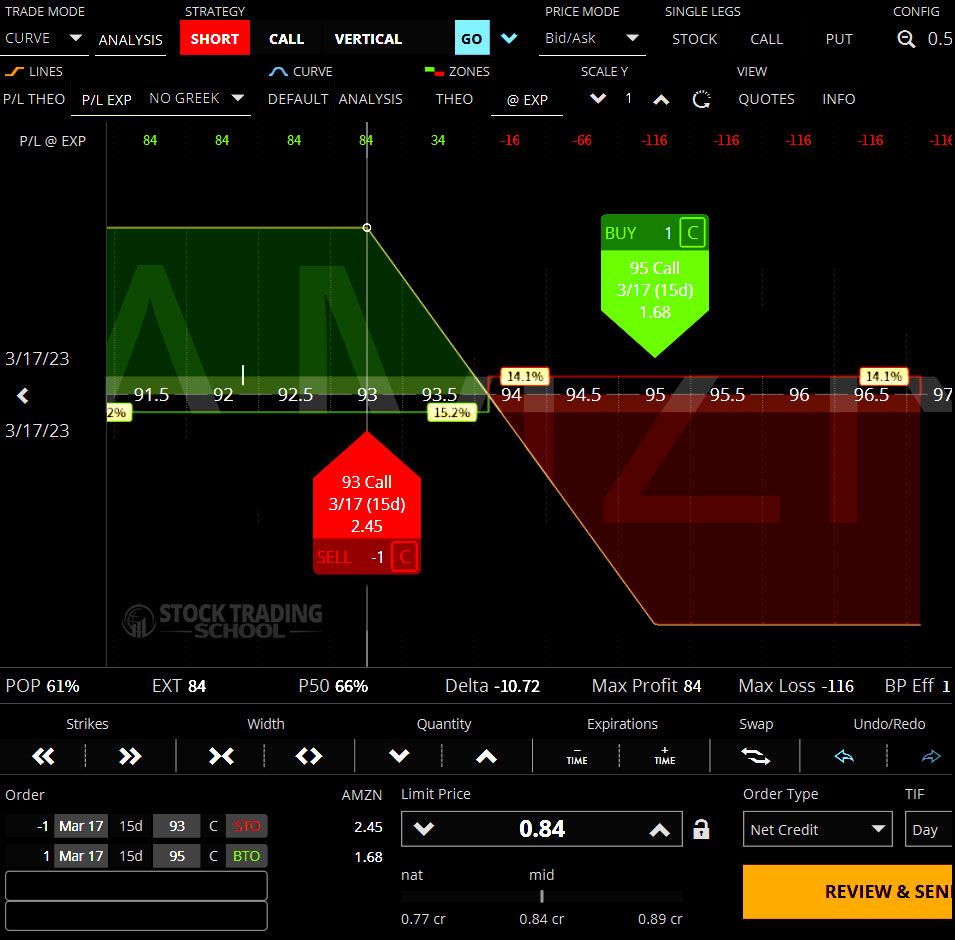

The example in the image above illustrates how an options trader can buy a call option with a strike price of $93 and sell a call option with a strike price of $95 simultaneously resulting in a vertical spread, which is one of the intermediate options strategies covered in this lesson. This options strategy is also called Bull Call Spread since the options trader’s maximum profit is reached if the stock moves up in price. The image below illustrates the potential profit and loss.

One of the most popular intermediate options trading strategies is vertical spreads. The above diagram illustrates the profit and loss potential for a Bull Call Spread that is long the $93 call and short the $95 call. The cost of the bull spread in this case is:

$0.84 x 100 = $84

The maximum loss is equal to the cost of the spread which is $84. The maximum loss lies below the long call strike price which is $93 at which point the call option is worthless at expiration. The maximum profit is the distance between the strike prices minus the cost of the spread which is:

($95-$93) x100 – $84 = $116

The maximum profit of $116 lies above the short call strike price which is $95

Debit Spreads Versus Credit Spreads

Debit spread and credit spread are two common options trading strategies used to profit from directional moves in the underlying asset while limiting the potential losses. The main difference between these two strategies lies in the initial cash flow.

A debit spread involves buying an option at a lower strike price and selling an option at a higher strike price, with the cost of the long option being higher than the credit received from the short option. The difference between the two premiums is the debit, and it represents the maximum loss that the trader can incur if the underlying asset does not move as anticipated. The maximum profit potential from these options trading strategies is the difference between the strike prices minus the debit paid. The Bul Call Spread example above is a debit spread, since the options trader pays $84 to open the vertical spread position.

On the other hand, a credit spread involves selling an option at a higher strike price and buying an option at a lower strike price, with the credit received from the short option being higher than the cost of the long option. The difference between the two premiums is the credit, and it represents the maximum profit that the trader can earn if the underlying asset moves as anticipated. The maximum loss potential is the difference between the strike prices minus the credit received. It is important to understand the differences of these options trading strategies. Both debit spreads and credit spreads are versatile options trading strategies that can be used to profit from directional moves in the underlying asset while limiting the potential losses. The following example will illustrate how options traders can utilize intermediate options trading strategies such as a bull put spread, which in this case is a credit spread to speculate on a bullish directional price movement on the stock.

Vertical Spreads: Bull Put Spread

A bull put spread is one of the intermediate options trading strategies that is used when an investor believes that the underlying stock or ETF will rise or stay flat over the near term. This strategy involves selling a put option with a higher strike price and buying a put option with a lower strike price. Both options have the same expiration date.

The objective of the bull put spread is to generate income from the premiums received by selling the higher strike put option while limiting the potential losses with the purchase of the lower strike put option. The premium collected from selling the put option with a higher strike price is higher than the premium paid for the put option with a lower strike price, resulting in a net credit to the investor’s account.

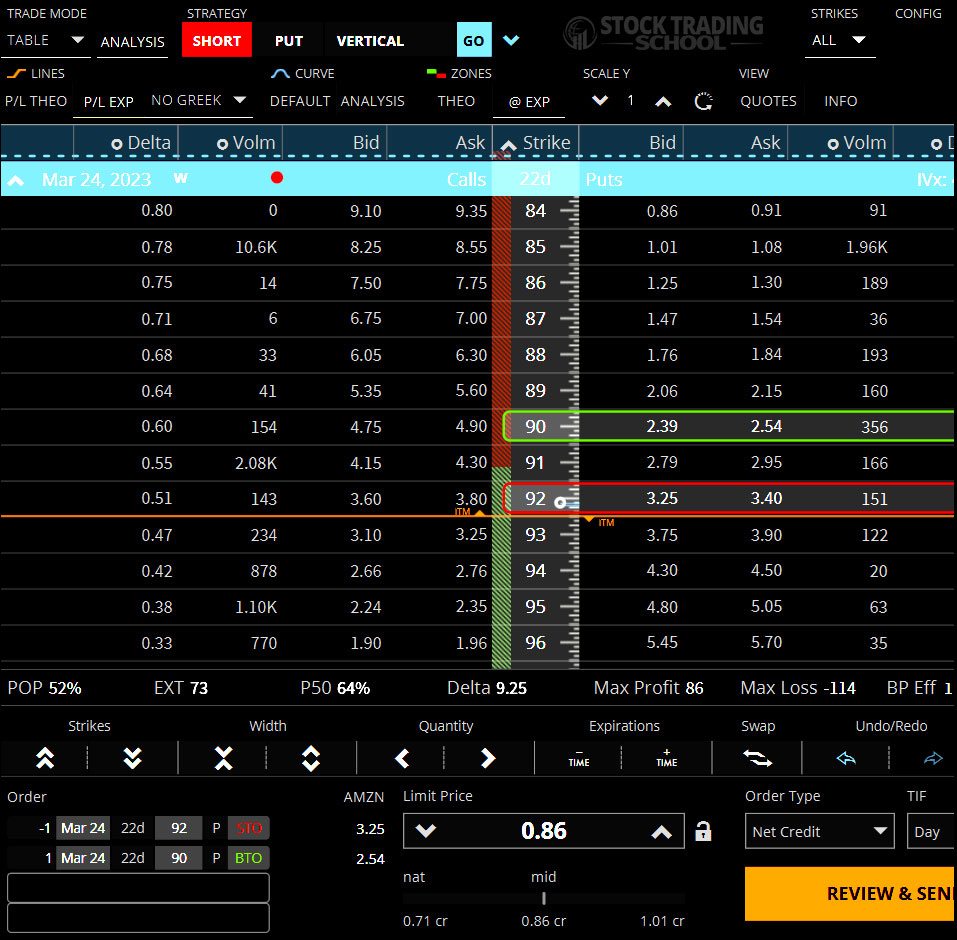

The example in the image above illustrates how an options trader can sell a put option with a strike price of $92 and buy a put option with a strike price of $90 simultaneously resulting in a vertical spread, which is one of the intermediate options strategies covered in this lesson. This options strategy is also called Bull Put Spread since the options trader’s maximum profit is reached if the stock does not decline in price. The image below illustrates the potential profit and loss.

One of the most popular intermediate options trading strategies is vertical spreads. The above diagram illustrates the profit and loss potential for a Bull Put Spread that is long the $90 put and short the $92 put. The credit received for the bull put spread in this case is: $0.86 x 100 = $86

The maximum profit is equal to the credit received for the spread which is $86. The maximum profit lies above the short put strike price which is $92 at which point the put option is worthless at expiration. The maximum loss is the distance between the strike prices minus the credit received for the spread which is:

($92-$90) x100 – $86 = $114

The maximum loss of $114 lies below the long put strike price which is $90.

Both the bull put spread and bull call spreads are a limited risk, limited reward options trading strategies. It is considered a bullish strategy because the investor profits from the stock or index price remaining stable or rising. This strategy is often used in neutral to slightly bullish market conditions.

It is important to reiterate that basic options trading strategies, intermediate options trading strategies, including bull call spreads and bull put spreads, and advanced options trading strategies as well, involve risks and may not be suitable for all investors. It is always recommended that investors thoroughly understand the risks involved and consult with a financial advisor before making any investment decisions.

Vertical Spreads: Bear Put Spread and Bear Call Spread

Bear spread is one of the intermediate options trading strategies that is used when the investor is expecting the price of stock or ETF to decline. This strategy is used by options traders who are bearish on the market or a particular stock.

Bear Put Spread: A bear put spread is an options trading strategy that involves buying a put option at a specific strike price while simultaneously selling a put option at a lower strike price. The idea behind this strategy is to generate profit from the difference in premiums between the two options. The maximum profit is achieved if the price of the stock or ETF goes below the lower strike price of the put options. However, if the price of the stock or ETF increases, the options trader will experience a loss.

The example in the image above illustrates how an options trader can buy a put option with a strike price of $92 and sell a put option with a strike price of $90 simultaneously resulting in a vertical spread, which is one of the intermediate options strategies covered in this lesson. This options strategy is called Bear Put Spread since the options trader’s maximum profit is reached if the stock decline in price. The image below illustrates the potential profit and loss.

One of the most popular intermediate options trading strategies is vertical spreads. The above diagram illustrates the profit and loss potential for a Bear Put Spread that is long the $92 put and short the $90 put. The cost of the bear put spread in this case is:

$0.86 x 100 = $86

The maximum loss is equal to the cost of the spread which is $86. The maximum loss lies above the long put strike price which is $92 at which point the put option is worthless at expiration. The maximum profit is the distance between the strike prices minus the cost of the spread which is:

($92-$90) x100 – $86 = $114

The maximum profit of $114 lies below the short put strike price which is $90

Bear Call Spread

A bear call spread is one of the intermediate options trading strategies that is used when the investor is expecting the price of stock or ETF to decline. This options trading strategy involves selling a call option at a specific strike price while simultaneously buying a call option at a higher strike price. This strategy is used when the trader expects the price of the underlying asset to decline. The maximum profit for this strategy is achieved when the price of the underlying asset remains below the higher strike price of the call options. However, if the price of the underlying asset increases, the options trader will experience a loss.

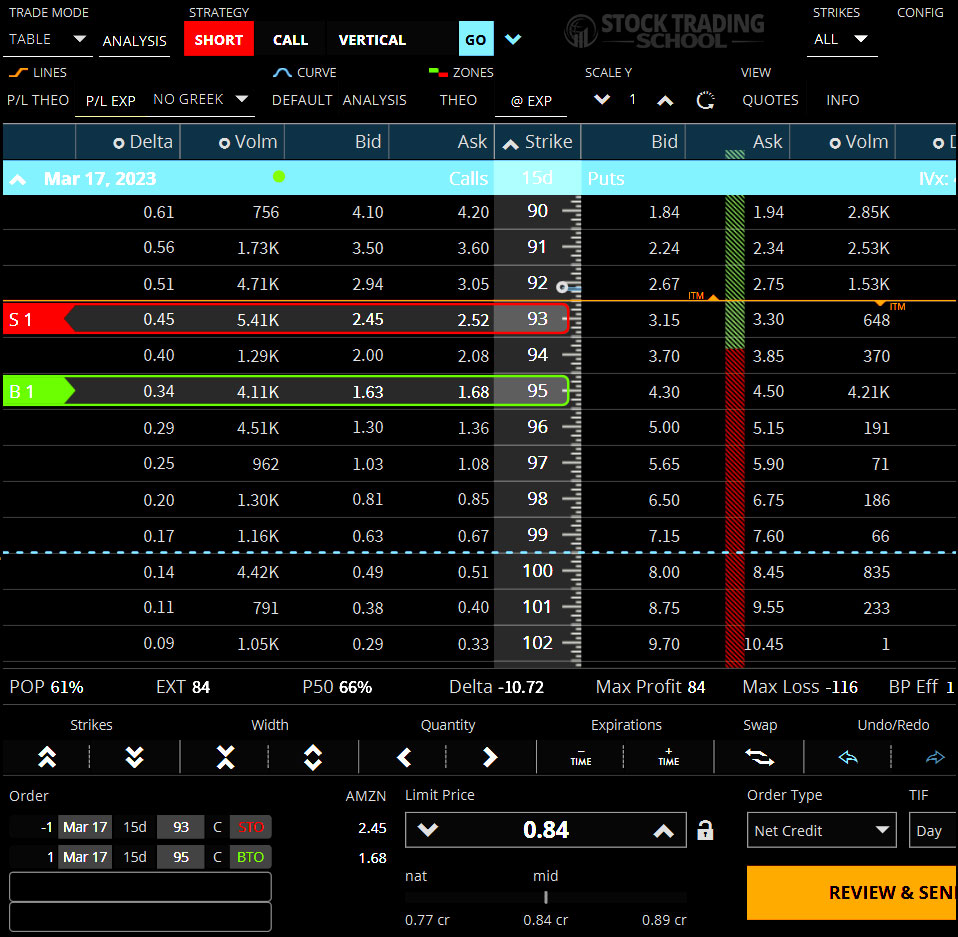

The example in the image above illustrates how an options trader can sell a call option with a strike price of $93 and buy a call option with a strike price of $95 simultaneously resulting in a vertical spread, which is one of the intermediate options strategies covered in this lesson. This options strategy is also called Bear Call Spread since the options trader’s maximum profit is reached if the stock does decline in price. The image below illustrates the potential profit and loss.

One of the most popular intermediate options trading strategies is vertical spreads. The above diagram illustrates the profit and loss potential for a Bear Call Spread that is short the $93 call and long the $95 call. The credit received for the bear call spread in this case is: $0.84 x 100 = $84

The maximum profit is equal to the credit received for the spread which is $84. The maximum profit lies below the short call strike price which is $93 at which point the call option is worthless at expiration. The maximum loss is the distance between the strike prices minus the credit received for the spread which is:

($95-$93) x100 – $84 = $116

The maximum loss of $116 lies above the long call strike price which is $95.

Both the bear put spread and bear call spread options trading strategies include a combination of buying and selling options to generate a profit while limiting potential losses. These options trading strategies have limited risk and limited reward, meaning that both the profit potential and the potential loss are capped.

Intermediate options trading strategies such as bull spreads and bear spreads can be useful for traders who are either bullish or bearish on the market or a particular stock. By using bull spreads and bear spreads, traders can take advantage of market conditions without having to worry about the underlying asset moving too far in either direction. As with any options trading strategy, options traders should fully understand the risks and rewards involved before implementing these options trading strategies, and to use risk management for options trading. Remember to only trade with money that you can afford to lose.

Horizontal Spreads (Calendar Spreads)

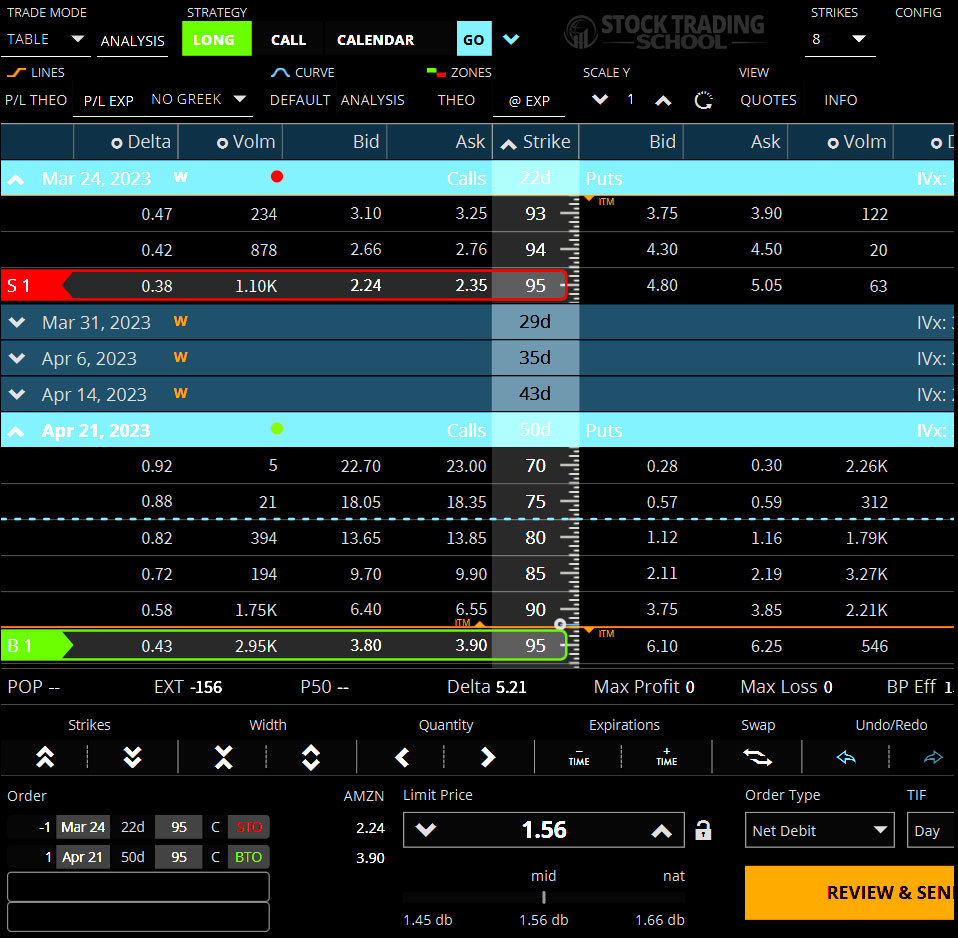

A horizontal spread, also known as a calendar spread, is a type of options trading strategy that involves the simultaneous purchase and sale of options with the same strike price, but different expiration dates. The goal of a horizontal spread is to profit from the difference in time decay between the two options.

A calendar spread is created by purchasing a longer-term option and selling a shorter-term option at the same strike price. For example, an options trader might buy a call option on a stock with a strike price of $50 that expires in six months, and simultaneously sell a call option on the same stock with the same strike price that expires in one month.

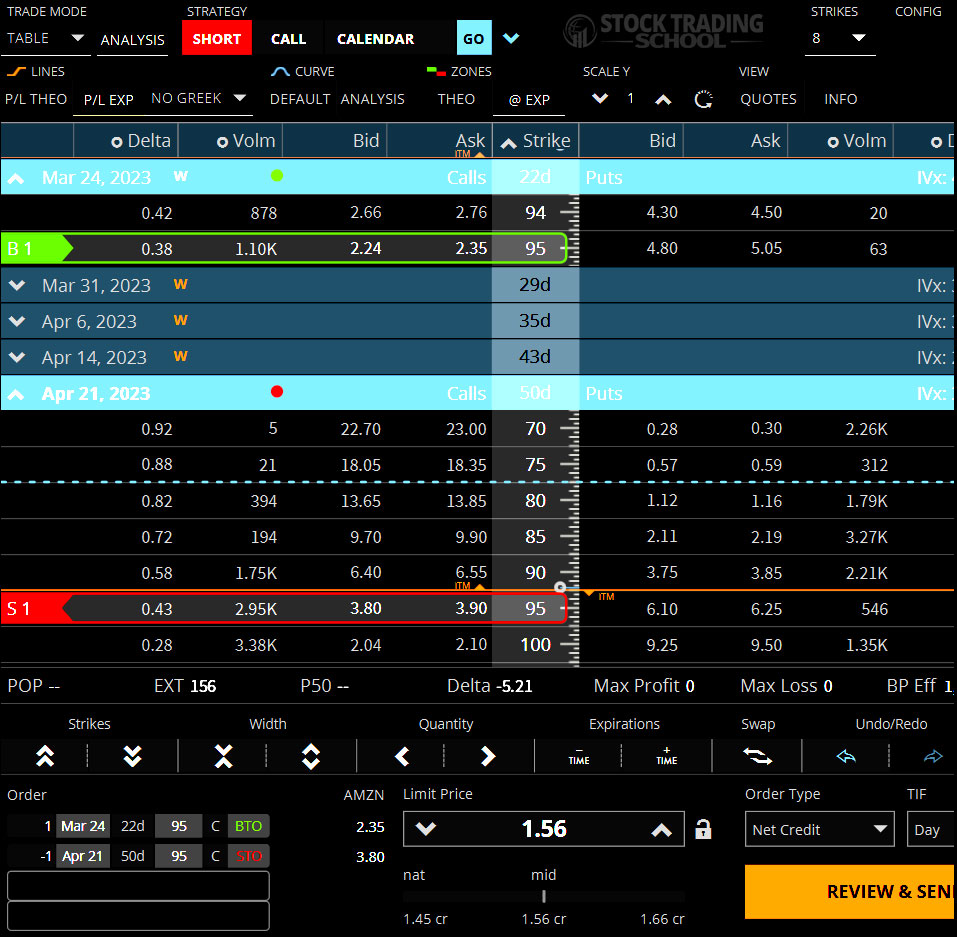

The example in the image above illustrates how an options trader can simultaneously sell a call option with a strike price of $95 strike expiring on March 24, and buy a call option with a strike price of $95 expiring April 21 resulting in a horizontal spread, which is one of the intermediate options strategies covered in this lesson. This options strategy is also called Calendar Spread since the options expiration dates are in different dates on the calendar.

The key to a successful horizontal spread is for the underlying asset to remain relatively stable during the life of the shorter-term option. If the asset price remains stable or only moves slightly, the shorter-term option will expire worthless, while the longer-term option retains its value. The options trader can then sell the longer-term option at a profit.

However, if the underlying asset price moves significantly in either direction, it can result in a loss for the options trader. If the price moves up, the short-term option may need to be bought back at a higher price, resulting in a loss. If the price moves down, the longer-term option may lose value, resulting in a lower profit or even a loss.

The example above illustrates how an options trader can also choose to take the other side of the trade and basically short the calendar spread. A short horizontal spread, also known as a short calendar spread, is an options trading strategy where the trader sells a near-term option and simultaneously buys a further out option with the same strike price. This strategy is the opposite of the long horizontal spread, where the trader buys the near-term option and sells the further out option.

Overall, horizontal spreads are a popular options trading strategy among traders who want to take advantage of time decay and volatility while minimizing their risk. By carefully selecting the strike price and expiration dates, traders can create a spread that has a high probability of success. However, as with any stocks and options trading strategy, it’s important to manage risk and limit potential losses.

Diagonal Spread

A diagonal spread is an options trading strategy that involves buying and selling options with different strike prices and expiration dates. It is a combination of a vertical spread and a horizontal spread. In a diagonal spread, the options trader buys a longer-term option and sells a shorter-term option with a different strike price, usually at a lower premium. The difference in strike prices between the two options is known as the spread. The goal of this strategy is to capitalize on the time decay of the shorter-term option while still maintaining a long position on the underlying asset.

For example, suppose an options trader is bullish on a particular stock and wants to use a diagonal spread to capitalize on the expected increase in stock price over time. The trader could buy a call option with a strike price of $100 expiring in six months and sell a call option with a strike price of $110 expiring in two months. This creates a diagonal spread with a $10 spread between the two options.

The benefit of using a diagonal spread is that it can provide a higher potential profit compared to a straight long or short position. Additionally, the premium received from selling the shorter-term option can help offset the cost of buying the longer-term option.

Intermediate options trading strategies like diagonal spreads also carry risks. If the stock does not move in the expected direction, the options trader can realize losses. The limited profit potential and potential for losses may not make it an ideal strategy for all traders. Diagonal spreads are a versatile options trading strategy that can be used in a variety of market conditions. They require careful analysis of market trends and an understanding of the risks involved in order to be successful. Options traders should always practice proper risk management and have a well-defined trading plan when using intermediate options trading strategies.

Get FREE Early Access to

Exclusive Trading Content!

Find the Next BIG Investment Opportunity Before Everyone Else

This concludes the Intermediate Options Trading Strategies lesson. Please use the menu below to navigate to the lesson of your choice.